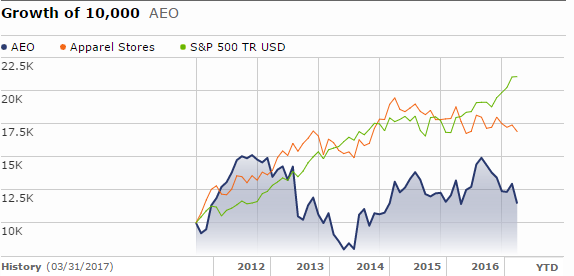

American Eagle Outfitters' (NYSE:AEO) shares have shown a rather poor performance over the last five years relative both to the peers and the market as a whole. As evident from the graph, the stock has been closely following its peers since 2014 after the initial demise in 2012-2013. Although there is a wide spread between the returns, it should be mentioned that the five-year monthly average beta remains at 0.85 which implies there is a good chance that the stock may follow the S&P 500 index in the long-term (provided fundamentals do not disappoint).

(Source: Morningstar.com)

The history of the stock's returns is a bit puzzling given the company's relatively high performance indicators. In terms of profitability metrics, American Eagle Outfitters has one of the best ROE and ROA metrics of 18.8% and 12.5%, respectively. There is much to be done to reach Gap's (NYSE:GPS) numbers in terms of ROE and Buckle's (NYSE:BKE) figures in terms of ROA. It is important to mention that the company has a relatively strong net profit margin of 5.9% compared with Abercrombie & Fitch's (NYSE:ANF) figure of 0.1%, for example.